3 keys to understanding inflation

Understand inflation and how it impacts your life and your finances

Reading time: 3 minutes

We have all heard inflation is running rampant recently —hitting a 40-year high of 8.5% in the US—, but what does it really mean and how does it affect us?

Inflation affects us more directly than we think. So, let’s see the 3 keys to understanding what inflation is.

In this article we’ll explore:

Key 1: What is inflation?

Key 2: How does it affect me?

Key 3: How do I hedge against it?

Let’s begin.

Key 1: What is inflation?

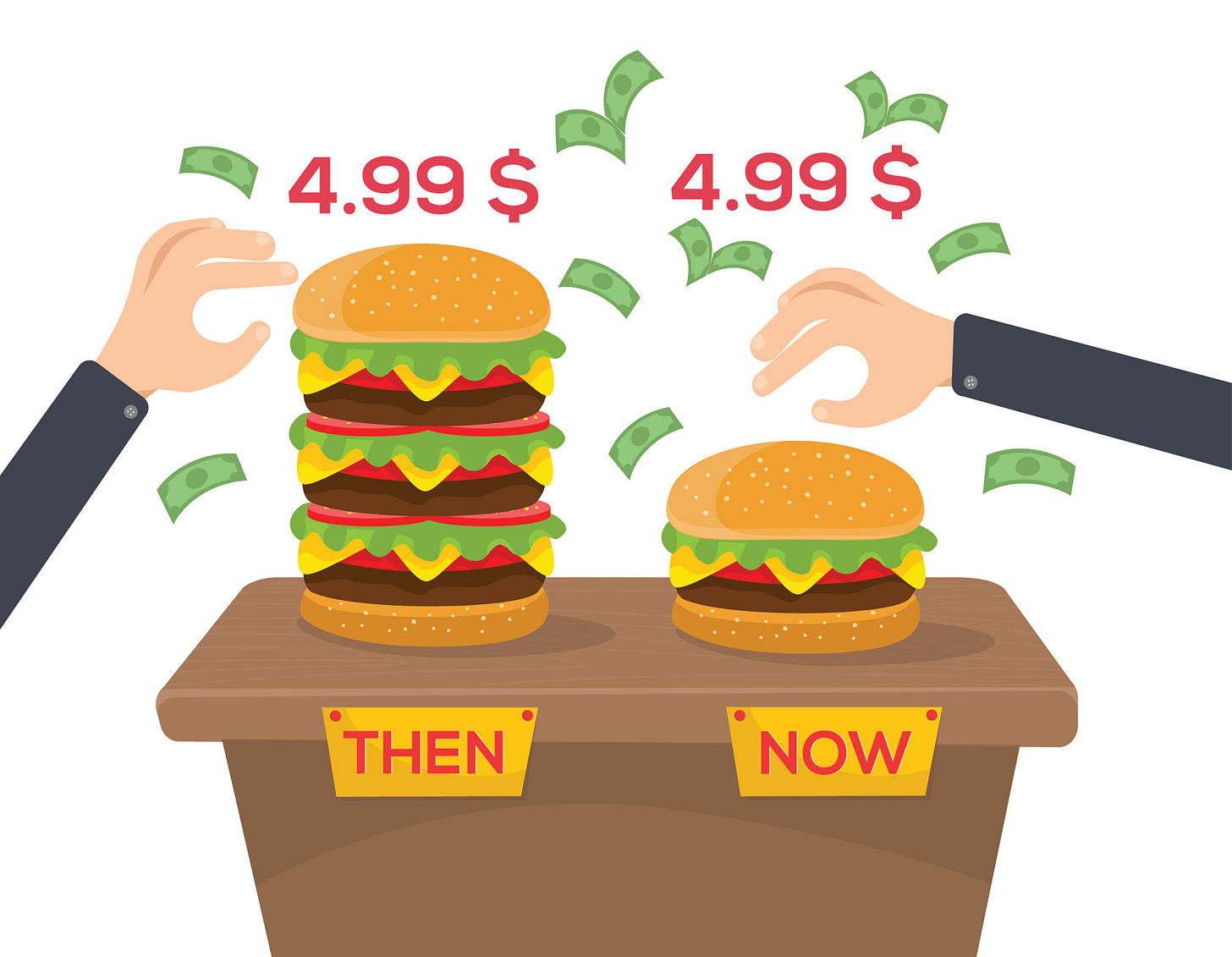

Do you remember your grandparents saying that prices have risen a lot since they were young? They were absolutely right.

In 1980 sliced bacon cost $1.46 per pound. Today, in 2022, the cost has risen to $6.64. The price of sliced bacon has increased 4.5 times over that period, and that is what we call inflation.

Inflation is not a local phenomenon, it occurs worldwide. And it isn’t only bacon that increases in price, but all products and services. For example, prices of coffee have also increased over time in the US:

Key 2: How does it affect me?

Inflation affects our finances directly because all products and services around us become more expensive. If everything around us becomes more expensive, we’ll be able to purchase fewer items with the money we make. In other words, we are getting poorer.

Your Income

Imagine you make $1,400 every fortnight. If all prices around you increase 10%, it’s like losing 10% of your income —you’ll then be making $1,260 per fortnight.

With a lower wage, we won’t be able to buy the same amount of products and services —we’ll be able to buy less—, therefore, our purchasing power diminishes. Again, that means we are getting poorer.

Your Savings

Imagine you have $10,000 saved in the bank. With a 10% annual inflation, you’ll be losing 10% of your saved money every year.

After the first year, your $10,000 would be worth $9,000

After the second year, your $9,000 would be worth $8,100

After the third year, your $8,100 would be worth $7,290

After the fourth year, your $7,290 would be worth $6,561

And so on…

Inflation makes our purchasing power diminish by devaluing our capital. The higher inflation is, the faster our impoverishment will be.

The hidden tax

Inflation is a hidden tax. Although we don’t realise we are paying it, our money is decreasing year after year.

Do we really want to continue paying this tax that makes us poorer? We already pay enough taxes.

Key 3: How do I hedge against it?

There are various ways to fight against inflation, but the best of all is: investing.

5 ways to beat inflation

The only way to hedge against inflation is to ensure more money is coming in than going out. Remember, the higher this hidden tax is, the more money will go out of our pocket.

When we put our capital to work —either our savings or a small part of our regular income—, we are making sure our money is working for us little by little. It is a sum of inflows and outflows of money.

On the one hand, we have inflation eroding our money and, on the other hand, investing, which generates capital.

Inflation makes us lose money

Investing makes us make money

If we can increase our capital at the same pace —or higher— that of inflation (8.5% currently), inflation will not affect us whatsoever.

If we don’t do anything about it, our money will devaluate little by little. Check how much meat prices have increased:

“I remember the $0.05 hamburger and a $0.40-per-hour minimum wage, so I've seen a tremendous amount of inflation in my lifetime. Did it ruin the investment climate? I think not.”

— Charlie Munger

We must put our money to work to generate capital while we are asleep. Year after year. That way, we’ll be hedging against inflation.