Is Microsoft a good investment?

The behemoth Microsoft is down 30% year-to-date and some investors are getting lured

Microsoft, the big tech company known worldwide, has been going through some pain this year. Its stock is down 30% from its all-time highs and it is time to check whether investing in the company is a good idea.

In this article, we’ll explore:

What is Microsoft

Microsoft’s Business Model

How profitable is Microsoft

Valuation

Don’t forget to subscribe to get more stock analysis.

What is Microsoft

Microsoft is an American technology corporation that offers a wide range of products such as computer software, consumer electronics, personal computers and cloud services.

We all know Microsoft for its famous Microsoft Office suite —which we’ll cover later— and its operating systems, but the company has reinvented itself in the last 10 years, entering different new businesses and is set for the future

Founded by Bill Gates and Paul Allen in 1975, Microsoft has become one of the largest corporations in the world and its products are well-known and used by almost everyone with access to a computer in one way or another.

Microsoft’s Business Model

Microsoft’s business model is quite simple —which is good, we always look for companies whose business model we can understand. The company sells tech products and services, and they can be classified by the crown jewel of each section:

Microsoft 365 — officially called Productivity and Business Processes

Azure — officially called Intelligent Cloud

Windows — officially called More Personal Computing

Let’s briefly explore them.

Microsoft 365 (Productivity and Business Processes)

This section covers the company's most famous product, Microsoft Office suite (now called 365), and other products such as LinkedIn, Microsoft Dynamics and other productivity and business processes.

Microsoft 365 is a subscription-based service that offers access to the package of software we all have used (and are probably using still) in our life: Word, Excel, Outlook, PowerPoint, OneNote, OneDrive, Teams, etc. The great thing about Microsoft 365 is that it has a huge moat around it.

What is a moat? A moat is a durable competitive advantage that makes a business (or a product) impossible to compete against. And Microsoft 365 has a strong one: High Switching Cost.

Almost all companies in the world write their documents in Microsoft Word, run their numbers on an Excel sheet, send emails using Outlook, and create presentations with PowerPoint. Can you imagine any large company deciding to stop paying for Microsoft 365 and trying to find another supplier of such products? They will have a hard time finding a good substitute, and the hassle and costs associated with that decision would be huge. Therefore, companies will always be willing to pay a bit more to keep Microsoft 365. It is a great, sticky product.

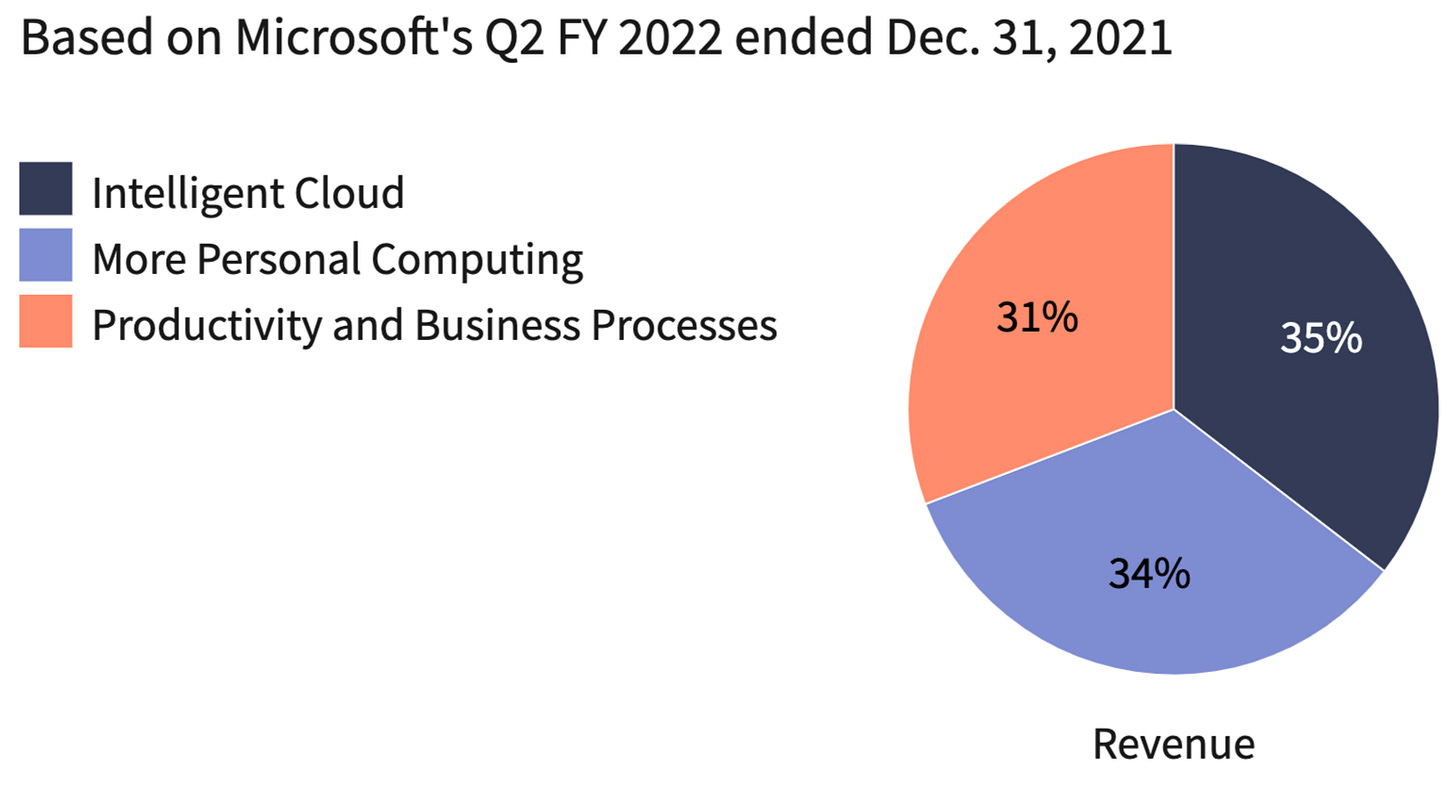

This section accounts for around 31% of Microsoft’s revenue.

(Source: Investopedia)

Azure (Intelligent Cloud)

This section also includes other services like SQL Server, Windows Server, GitHub, and Enterprise Services, however, the crown jewel here is Azure.

Azure is Microsoft’s cloud computing service offering: storage services, mobile services, identity services, data management services, messaging and media services among other things.

Cloud Computing is getting bigger and bigger as the world progresses. Some years back, Amazon's cloud computing segment (AWS) was completely dominating the market, however, everything is changing now. Azure is catching up.

In 2017, Azure accounted for only 13% of the market share in the cloud computing sector. In 2022, Microsoft managed to increase its market share up to 21%.

(Source: Statista)

The future looks bright for the cloud industry, and Microsoft is well-positioned to take advantage of that. Azure also has a moat around it. It actually has two: High Switching Costs and Integration.

High Switching Cost: As discussed before, large enterprises tend to avoid migrating data and services as much as possible. This is because they don’t want to lose time and money (and risk that something goes wrong and the business has to stop its operations) if it is not utterly necessary.

Integration: Being a Microsoft tool, Azure is well-integrated with other applications that belong to the same company. That is a huge advantage. If a company is already using Microsoft 365 and is to purchase a cloud computing service, what is easier, to stay with Microsoft (Azure) that ensures the service is integrated with 365, or go for Amazon (AWS)? The latter doesn’t seem like a very sound idea.

This section accounts for around 35% of Microsoft’s revenue.

Windows (More Personal Computing)

This section includes the famous operating system Windows, personal computers (Windows Surface) and Gaming.

Again, the operating system Windows is widely used for the same reasons we mentioned before: High Switching Costs and Integration.

Could large enterprises and small consumers use Apple OS instead? Yes, of course. However, Windows 365 works best with Windows OS. Therefore, it is not likely for someone to switch operating systems without a big reason.

When it comes to Gaming, Microsoft also has positioned itself for the future. Gaming is here to stay, and will only grow in the upcoming years. Apart from owning Xbox Games Studios, Microsoft has recently announced its intent to acquire Activision Blizzard —which is currently the fifth largest gaming company— for $68.7 billion in cash. Should the deal go through, it will make Microsoft the largest gaming company surpassing Sony (PlayStation) and Tencent.

This section accounts for 34% of Microsoft’s revenue.

How profitable is Microsoft

Microsoft is tremendously profitable. It is in fact a cash-producing machine.

Let’s take Microsoft’s Fourth Quarter Results 2022 (from April to June) for example.

Revenue: $51.9 billion

That means Microsoft has sold in only three months almost $60 billion worth of products and services.

Net Profit: $16.7 billion

That means Microsoft has, after paying for all the costs, research and taxes, made almost 17 billion in profit only in one quarter. That is insane.

Let’s see the entire breakdown with a chart.

(Source: Genuine Impact)

Valuation

We have seen how good of a company Microsoft is. The question that arises now is: Is it a good investment?

To answer that, we need to check that Microsoft shares are being sold at a good price. Let’s do a quick valuation.

We ran a 10-year Discounted Cash Flow analysis on Microsoft with the following assumptions:

Growth rate (from year 1 to 5): 12%

Growth rate (from year 5 to 10): 8%

Discount Rate: 15%

Terminal Value: 20

Although Microsoft has been growing its free cash flow on average at a 16% annually for the last five years, we must be conservative because large companies cannot continue growing at the same pace. Therefore, we assumed a growth rate of 12% (first five years) and 8% (last five years).

We obtained an intrinsic value after 10 years of $1.16 trillion for the whole enterprise —which translates into $155 per share.

If we are to apply a 30% margin of safety, we would like to buy the enterprise at $108 per share.

The current price for Microsoft is $232 per share. So, it should go down almost 50% for us to be interested. At current prices, Microsoft will most likely deliver around an 8% annual return over the next 10 years with conservative assumptions, making it an average investment.

If you are looking for just for an average investment (8% annual return), buying into Microsoft seems to be a good idea. However, if you are looking for excellent investments (above 15% annual return), Microsoft is trading at prices well above our requirements.

What is your view on the current macro environment and the certainty that Microsoft could offer to perform in shrinking economic environments? As it already did in the financial crisis of 08