Risk, volatility and how to invest intelligently

The difference between risk and volatility and the best way to navigate through them

Reading time: 4 minutes

Investing might feel risky and overwhelming for many people, but it shouldn’t be.

Investing is, in the end, about minimising the risk of permanent loss of capital whilst letting our money work for us at night. In other words, avoid losing money.

To invest successfully, we must understand the difference between risk and volatility.

What is risk?

In investing, risk is defined as the possibility of losing our money permanently. For example, we buy into a company that soon goes bankrupt and. If that happens, we lose all our money. And that is exactly what we must avoid.

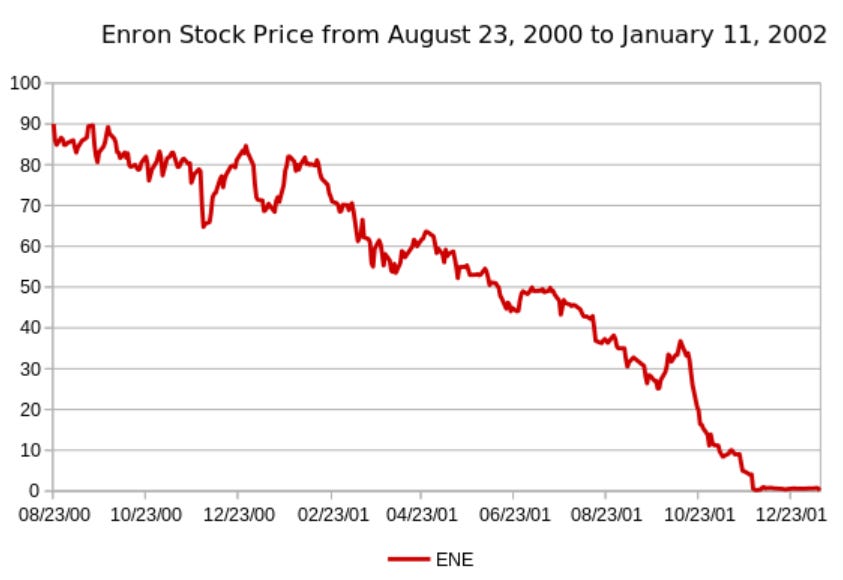

Here is an example of Enron, a company that went bankrupt. You can see that the stock price went from $90 to $0. You would have lost whatever amount you had invested.

What is volatility?

As opposed to risk, which is a permanent downtrend of the stock price of a company, volatility is the temporary movement —up or down— of the price. In other words, it is a temporary fluctuation of the price.

The great thing about volatility is that it can be our friend because it gives us a buying opportunity.

Here is an example of volatility. You can see here the example of Bank of America. Its stock price has fluctuated a lot since 1982 —it lost 94% of its value during the financial crisis in 2008—, but it has followed an upward trend overall going from $1.5 per share in 1982 to the current $36 per share.

If you had invested in Bank of America in 1982 you would have made more than 24 times your money (excluding dividends) despite all the price fluctuation. This is volatility.

Why is volatility our friend?

We now know that volatility is the temporary fluctuation of the stock price. Then, if we deeply understand a business and what it is worth, we can take advantage of the volatility when the stock price drops significantly.

Taking Bank of America as an example, Charlie Munger knew the value of the company in 2008 during the market crash. He was smart enough to buy shares at $3 dollars because he knew that the business was worth much more than that and could not go bankrupt.

14 years later, Charlie Munger has made more than 10 times his money —actually much more than that, because Bank of America pays a dividend.

This is exactly why volatility is our friend. If you know how much a business is worth and know that it won’t go broke, you can buy when the stock price falls sharply due to bad news or any special economic situations.

Taking advantage of volatility

When you have deeply analised a company and are sure the enterprise will do alright over time, the temporary fluctuation of its stock price is completely irrelevant.

Let’s use Meta (Facebook) as an example.

Meta is a great business that generates tones of cash and cannot —and will not— go broke any time soon. However, the stock price has dropped more than 50% from its peak.

If we know that Meta will not go broke and will do alright over time as a business, what are we afraid of?

The drop in its market price is an opportunity to buy into a great company at a very attractive price.

The only question you need to answer is: how much is the business worth? And buy when the price is lower than what is worth.

I wrote a short article about Meta, find it here:

If we already own shares of the business we have two options when the stock price falls sharply:

We ride out volatility and do nothing at all —selling would be the worst thing you could do. If it is a great company, its stock price will recover and do well over time.

We buy more shares of the great company. We are given a buying opportunity at an attractive price. If the business is still wonderful, why wouldn’t we want more shares of it?

Avoiding risk

To avoid a permanent loss of capital we must stay away from companies with the following characteristics:

Companies with high debt.

Companies that don’t produce a recurrent cash flow.

Companies within highly competitive environments.

Companies with low return on capital.

Companies with lousy management.

Companies that are not improving over time.

Companies we don’t understand.

Companies within disruptive industries which future we can’t predict.

Companies that are selling at very high prices.

Avoiding risk is the best protection against losing capital.