What do Spanish people invest in?

The statistics of Spaniards investing behaviour

The Bank of Spain has recently published its biannual household financial survey. It gives a detailed overview of the financial behaviour of Spaniards and allows us to draw some conclusions on how they invest.

Do Spaniards buy Real Estate?

Although in decline over the last two decades due to the lower purchasing power younger generations have suffered compared to their parents, Spaniards' main investment vehicle is real estate.

About 74% of Spanish households own property in 2020 — i.e. house, flat, apartment, etc.

Compared to the 81% seen in 2002, there is a clear downwards trend —accelerated by the 2008 financial crisis— that shows a significant reduction in property ownership among Spanish households.

This gets to show that owning property is widely seen as the way to go for Spaniards when it comes to deploying money.

Furthermore, the average price of the property they own is 125.000 euros.

The question that arises here is: are Spaniards buying property as an investment —thinking about the return on their capital deployed— or do they buy real estate because they want to own their house?

Either way, we see that owning a house is a common financial goal for Spaniards.

Do Spaniards buy stocks?

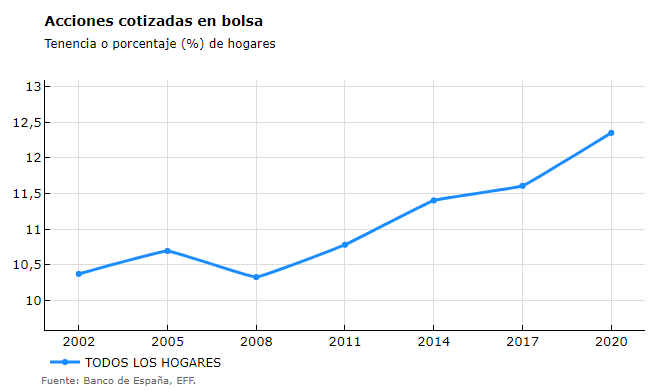

Surprisingly enough, stock ownership has been increasing over the last two decades. In 2002, only 10.4% of Spanish households had invested in the stock market, in 2020, 12.4% owned stocks.

This percentage is quite low, and it gets to show that, compared to other countries, Spain does not have the habit of investing in the stock market. If we look at the average amount invested in the stock market, the picture gets worse.

Those Spaniards who bought stocks only have an average of 6.500 euros invested in the stock market.

Do Spaniards own a car?

We can definitely say yes. More than 76% of Spanish households own a car. Although a car is for many a necessity, we are at all-time highs.

In addition, the average value of the car —it is not the price they paid when they bought it, but the current market value— is 8,000 euros.

Conclusions

This report shows how financially uneducated Spaniards are when it comes to investing in general but in the stock market in particular.

We see that almost a third of the households own a house and a car, but only 12.4% invest in the stock market. Furthermore, the value of the car (8.000 euros) is higher than the average investment in the stock market (6.500 euros). Spaniards seem not to be thinking about investing at all.

People don’t realise that stocks offer much greater returns over time than any other investment class. They are more focused on owning things —a house and a car— than improving their financial position. Instead of buying a house early on, they should invest in the stock market as soon as possible so they increase their net worth and can acquire two houses in the future.

Remember that investing, like everything in life, requires deferred gratification: you put money to work today, giving up other whims you have now to get more in the future. Only then you’ll be able to acquire what you want without messing up your finances and look after you wife and children.

Be patient. All the things that are worthwhile in this life take time.